How One Teacher Is Changing Lives Through Financial Literacy

Celebrating Financial Literacy Month with Nuvision Hero Tim Postiff

Why are we still sending kids out into the world without teaching them how money works?

It’s one of the most common questions we hear during Financial Literacy Month—and it’s one that hits close to home for Tim Postiff, longtime educator and AVID Program Coordinator at Costa Mesa High School. For 23 years, Tim has been more than just a teacher. He’s been a mentor, a coach, and a community leader. And lately, he’s been something else too: a financial literacy advocate.

Real-world skills like managing money aren’t getting the attention they used to in schools. That’s why Tim has been working with Nuvision to bring those lessons back into the classroom and give students the tools to make smarter choices with their money.

From Coaching to the Classroom

Tim’s journey into education started early. “I grew up playing sports and started coaching youth water polo when I was about 17 or 18,” he said. That early experience showed him how much of a difference one person can make in a young person’s life. A mentor in college later nudged him toward teaching, and he never looked back.

During his student teaching in rural Missouri, he was inspired by a mentor whose approach left a lasting mark. “He was a coach, teacher, bus driver—whatever the school needed. His philosophy was simple: make the school and the community better however you can. That’s something I’ve carried with me ever since.”

The Missing Curriculum: Money Management

At Costa Mesa High School, Tim leads the AVID program—short for Advancement Via Individual Determination. It’s a nationwide initiative aimed at preparing students for college and careers. But when Tim realized how many of his students were already working part-time jobs with little understanding of how to manage their money, he saw a need.

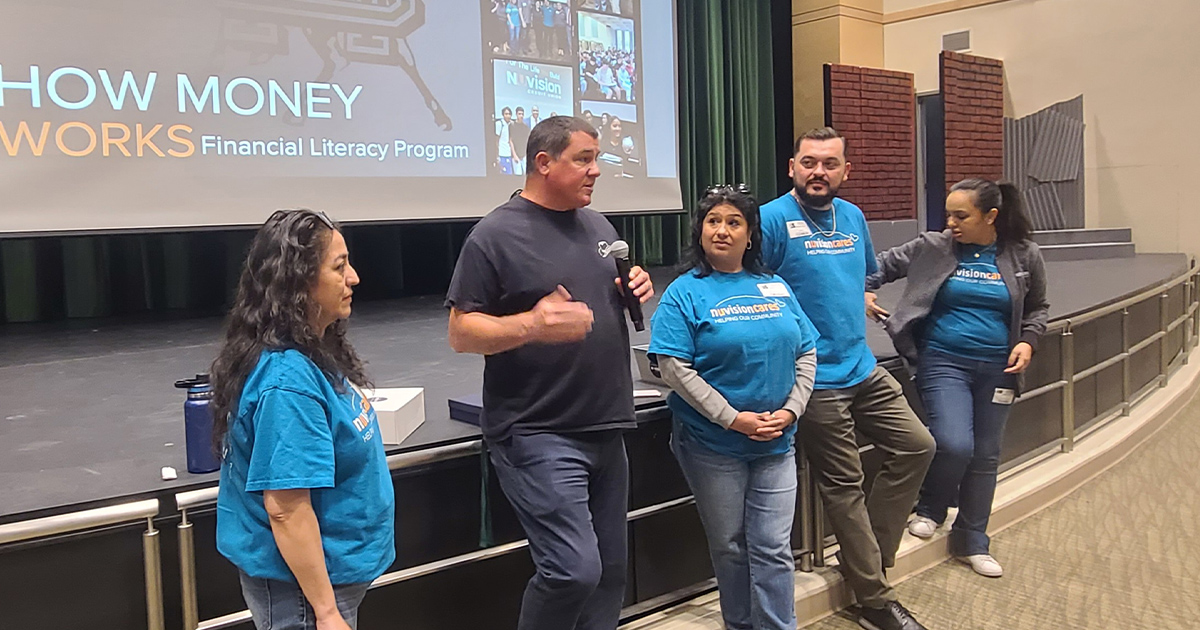

That’s when Nuvision stepped in.

“Some of our kids are working 25 hours a week. They’re bringing in paychecks, but they don’t know what to do with them,” Tim said. “Nuvision helped us bring in real, usable knowledge—stuff we just weren’t equipped to teach on our own.”

The Impact: Real-World Results

We’re already seeing real changes in how students think about money. “Some of our seniors are already changing how they handle money,” Tim said. “We’ve got kids setting up automatic savings withdrawals from their checks. They’re thinking long-term—even saving up for trips they thought were out of reach.”

And it’s not just the students learning. “One of our newer teachers sat in on a session and told me, ‘I didn’t even know you could do that. I’m using that for myself.’ So this is helping everyone, not just the kids.”

First-Generation Lessons, Lasting Skills

Many AVID students are first-generation high school graduates, and financial literacy is completely new to them. “For a lot of them, this is the first time they’ve heard about saving, investing, or planning,” Tim explained. “Just showing them that if you save a little each paycheck, you can build something—this is all new to them, and it matters.”

Advice for Other Teachers and Community Leaders

Tim’s advice to other educators: don’t wait. “Kids live in a world that’s almost completely cashless. They don’t feel the value of money because they never see it. It’s all digital. That makes it even more important to teach them how to manage it.”

And for community partners? Get involved. “Businesses have a huge role to play in this. These are your future employees, your future customers. The kids light up when someone from the community shows up and says, ‘Here’s how this works in the real world.’ It sticks.”

A Career Rooted in Connection

Tim’s not the kind of teacher who loses touch after graduation. “I’ve been invited to weddings, to meet kids' children—people I taught 20 years ago. It’s an amazing thing to stay connected and know you’ve had a lasting impact.”

His final advice for new teachers: “Every kid has something to offer. Some days the subject isn’t the most important thing—it’s the connection. Make them feel seen, every day.”

Celebrating Financial Literacy Month, One Classroom at a Time

Tim’s story is exactly why Nuvision launched our How Money Works program and continues to expand our financial literacy efforts. Students need more than facts and figures—they need mentors, real-world examples, and a chance to see how their choices today affect their future.

This April, we're proud to recognize Tim Postiff as a Nuvision Hero—and to honor the real impact he's making. And we’re even prouder to keep showing up in classrooms, side by side with leaders like him, to give students the financial tools they deserve.

Want to see how real change happens, one student at a time?

Visit nuvisionfederal.com/financialliteracy and see how we’re helping the next generation build stronger financial futures.