Enter Nuvision's Financial Literacy Month Challenge

Celebrate Financial Literacy Month by helping the next generation learn about money. We’ll be dropping short videos with real-world tips to help individuals answer their financial questions.

Simply follow the steps below to enter:

- Like Our Post.

- Follow Us On Social Media.

- Share Financial Tips in the Comments to be Entered to win.

Do you have a great tip to share? Comment with a tip related to the video’s topic and be entered to win a $25 Amazon Gift Card. For each weekly video posted, 3 winners will be selected based on their comment/tip pertaining to the selected topic for the week. - Stitch & Share.

Feeling creative? Stitch and share our video with your tip related to the video's topic to be entered to win a $250 Amazon Gift Card. The best video each week will win. 1 winner per topic. Remember to tag us in your video.

Weekly winners will be announced on social media each Friday. Use #NuvisionChallenge to stay connected.

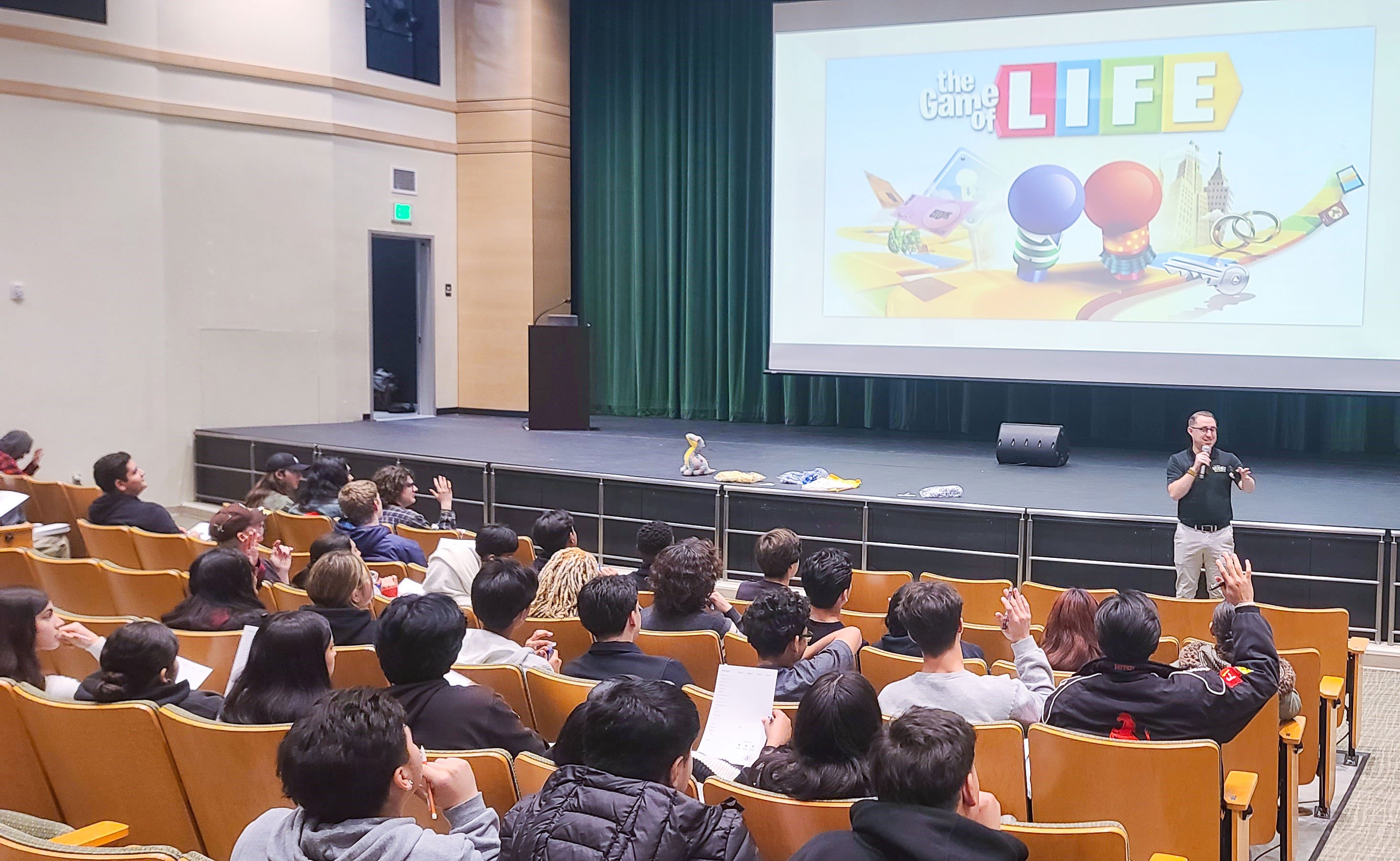

Nuvision Partners with the Community for Financial Literacy

Building on our commitment to community outreach, Nuvision has partnered with experts to teach monthly “How Money Works” classes at Costa Mesa High School, where we empower students to take control of their personal finances.

Right now, we’re in our eighth month of teaching the How Money Works program at Costa Mesa High School in Southern California. Every month, we’re in the classroom talking with students about real-life money management—how to budget, how credit works, how to stay out of debt—things they’re not learning anywhere else but absolutely need to know.

Your Journey to Financial Wellness

Starts Here

And if you haven’t checked it out yet, take a look at our Financial Wellness Center. It’s full of practical info for every age and every stage of life—whether you're trying to get out of debt, save more, or just get a handle on your finances.

Disclosures

No purchase necessary. Sweepstakes begins April 21, 2025, and ends May 2, 2025. Must be 18 years of age or older to enter. Void where prohibited.