Debt Stress Is Real; In fact, 77% of Americans Say TheY Struggle with Financial Anxiety

With total household debt in the U.S. reaching $17.987 trillion, it’s no surprise that many Americans feel weighed down by credit and debt concerns. The average American owes $104,215 across mortgages, student loans, auto loans, and credit card debt, often leading to financial stress and uncertainty. Managing debt and building strong credit may seem challenging, but there are ways to take control. Whether you’re looking to reduce debt, build a better credit score, or make smarter borrowing decisions, we offer the tools and guidance to help you succeed. Nuvision is here to help you make a plan to bring you closer to financial freedom.

Build a Strong Financial Future with Good Credit

Your credit score impacts more than just loan approvals—it affects interest rates, insurance premiums, and even job opportunities. A solid credit history opens doors and helps you save money in the long run. Whether you're working to establish, improve, or maintain your credit, we’re here to guide you. Discover strategies to build strong credit, correct issues, and make choices that set you up for a secure financial future.

Learn How to Build Strong Credit

Explore our expert tips and strategies for improving and maintaining your credit with these articles designed to help you unlock new financial opportunities and secure a brighter future.

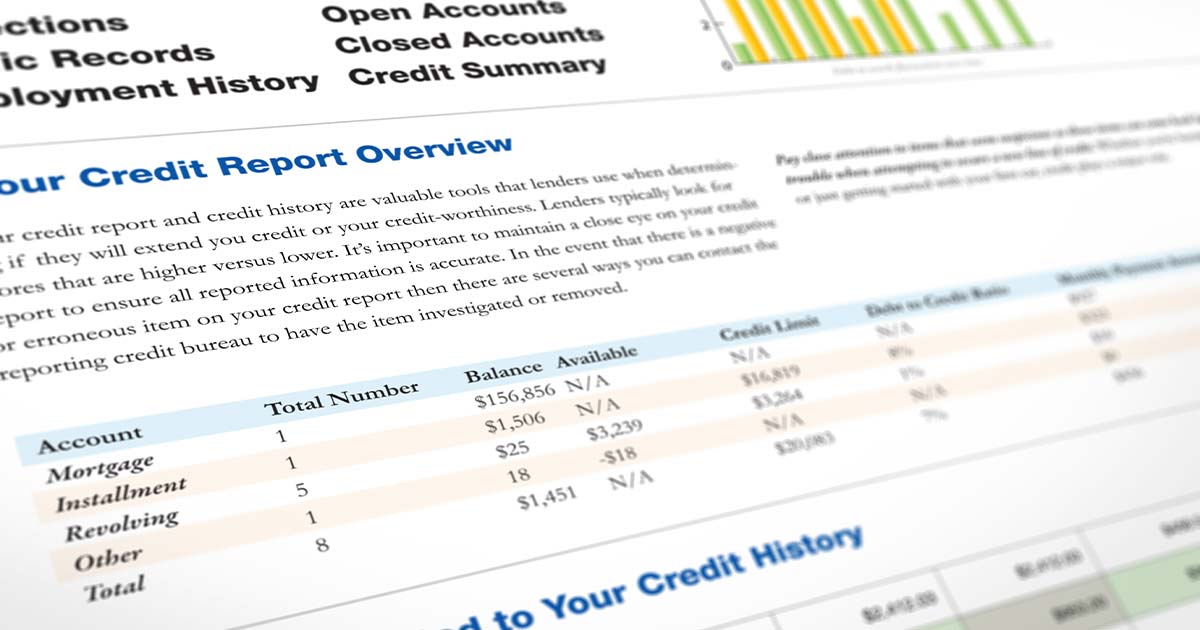

What is a Credit Report and Why It Matters

Discover what a credit report is, why it's essential, and how it impacts major life decisions. Learn what’s in a credit report, how to build or rebuild credit, and the importance of checking for errors.

Credit Scores: What They Mean and How to Improve Yours

Get to know what a credit score really is, why it matters, and how it affects your finances. Learn simple tips for building a good score without stressing over perfection.

Using Credit Wisely: Simple Tips to Make Credit Work for You

Learn how to use credit wisely with simple, effective tips. From paying on time to keeping balances low, discover smart habits to build good credit and make the most of your credit cards.

DEBT & DEBT MANAGEMENT STRATEGIES

Make Debt Work for You with Smart Management

Debt can be a valuable tool when managed wisely. Whether reducing existing balances or making strategic choices with new credit, we’re here to help. Understand interest, repayment options, and how to leverage debt for your goals—all while keeping debt stress in check.

Effective Tips for Managing Debt

Debt can feel overwhelming, but with the right strategies, you can take control, reduce financial stress, and build a path toward financial freedom. Managing debt isn’t about quick fixes—it’s about creating sustainable habits to keep you on track with your finances.

Understanding Debt Consolidation: A Simple Guide to Getting Out of Debt

Debt consolidation is all about making your financial life less complicated. It's when you take all your different debts - like what you owe on credit cards, student loans, or other types of loans - and merge them into one.

Financial Freedom: Six tips to help you get out of debt

Having debt hanging over your head can be a downer. It’s also a significant roadblock to financial freedom. Becoming debt-free is a worthy goal, but it’s going to take some work. Here are some of our some tips...

Cut Down Debt Efficiently with our Credit Card Optimizer Tool

The Credit Card Optimizer helps you find the smartest way to manage credit card debt. Take control of your debt and see how small changes can lead to big savings over time.

The Credit Card Optimizer helps you determine the best distribution of your credit card debt. By entering your credit card balances, rates and credit limits this calculator determines which balance transfers will produce the greatest savings.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

CREDIT & DEBT VIDEO RESOURCES

CREDIT & DEBT FAQS

A credit score is a three-digit number that summarizes your creditworthiness, while a credit report is a detailed record of your credit history. Your credit report includes information about your accounts, payment history, credit utilization, and any public records like bankruptcies. This report is used to calculate your credit score, which helps lenders, landlords, and sometimes employers assess your financial reliability. Together, they provide a picture of how you handle credit and debt.

Using a credit card responsibly means paying off your balance each month, keeping your spending within budget, and avoiding interest by paying in full. Keep your balance under 30% of your credit limit to protect your credit score, and consider setting up autopay to prevent late payments. These habits will help you avoid debt while building a positive credit history.

A high credit score can help you qualify for lower interest rates on loans, get approved for credit cards with better rewards, and even save on insurance premiums. While scores in the mid-700s can offer excellent benefits, financial experts agree that obsessing over a perfect 800+ isn’t necessary. As long as you maintain a “good” score, you’ll likely have access to favorable terms and rates.

Good debt is generally considered debt that helps build your future, like student loans, mortgages, or business loans, as these are investments that can increase in value or improve income potential. Bad debt usually includes high-interest debt used for consumable items or non-essential purchases, like credit card balances carried month-to-month. The key is whether the debt creates value or financial strain over time.

Debt affects your credit score in two main ways: how much of your available credit you’re using and whether you pay on time. High balances and missed payments can hurt your score, while paying on time and keeping balances low can help it. Reducing your debt over time also boosts your score by showing that you’re using less of your available credit.