Discover How to Get a Loan That Works for Your Needs and Financial Goals

Getting a loan can feel overwhelming, but it doesn’t have to be. With the right approach, you can secure a loan that fits your financial goals and makes life easier. Here’s everything you need to know to navigate the loan process with confidence.

STEP 1: Assess Your Financial Goals

Before you start applying, it’s important to know exactly why you need a loan and how much you plan to borrow. Whether it’s for a car, home, personal expense, or consolidating debt, having a clear purpose helps you choose the right loan type. Take time to evaluate your budget, income, and expenses to determine what you can comfortably afford to repay each month.

STEP 2: Understand Your Loan Options

Not all loans are created equal. Here’s a quick overview of common types:

- Personal Loans: Versatile loans you can use for almost anything, from medical bills to vacations.

- Auto Loans: Specifically for purchasing a new or used vehicle.

- Home Loans: Designed for buying or refinancing a home, including fixed and variable-rate options.

- Credit Cards: For ongoing expenses and building credit, though typically with higher interest rates than traditional loans.

Choosing the right loan depends on your specific needs and financial situation.

STEP 3

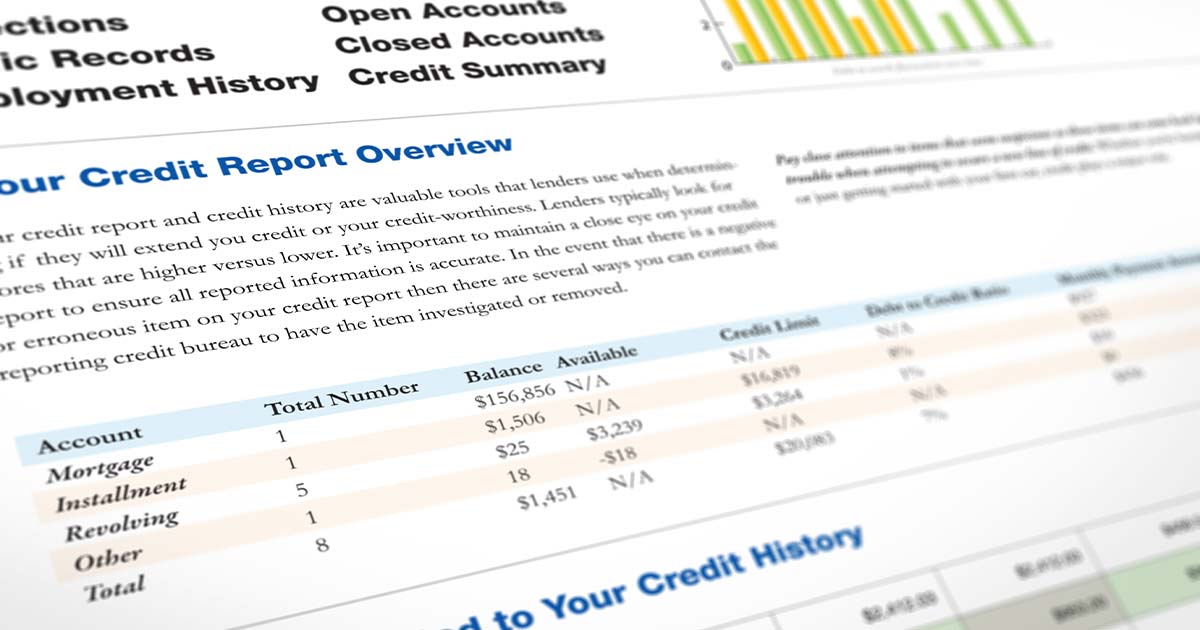

Check Your CREDIT REPORT

Your credit score plays a big role in determining the loan options available to you.

What is a Credit Report and Why It Matters

Discover what a credit report is, why it's essential, and how it impacts major life decisions. Learn what’s in a credit report, how to build or rebuild credit, and the importance of checking for errors.

Credit Scores: What They Mean and How to Improve Yours

Get to know what a credit score really is, why it matters, and how it affects your finances. Learn simple tips for building a good score without stressing over perfection.

STEP 4: Gather Necessary Documents

Lenders will typically ask for documents to verify your identity, income, and financial stability. Be prepared to provide:

- Proof of identity, like a driver’s license or passport..

- Proof of income, such as pay stubs or tax returns..

- Bank statements and possibly proof of residence.s.

Having these ready can speed up the process.

VIDEO RESOURCES: THE LENDING PROCESS

Calculate Your Loan Needs

See what your loan could look like with our easy-to-use calculator. Estimate payments, compare options, and find the loan that works for you.

HOW TO GET A LOAN FAQS

Want to open your first credit card?

Getting your first credit card is a great way to start building credit and managing your finances. The process is simple, whether you're applying online or visiting a branch. We’ll guide you through every step, so you can get your card quickly and start using it right away.

You can apply for a credit card online or at one of our branches.

To apply online:

- Visit our credit card page on the website.

- Select the card that best fits your needs.

- Complete the online application form.

- Make sure to have your personal information, income details, and social security number ready.

- Submit your application for approval.

To apply in-branch:

- Visit your nearest branch.

- Bring a valid ID, proof of income, and your social security number.

- Our staff will help you complete the application.

Ready to get your first vehicle loan?

Financing your next vehicle is easier than you think! Whether you’re looking to buy a new car or refinance your current loan, we make the process smooth and hassle-free. You can apply online or in-person, and we’ll guide you through each step, so you can hit the road in no time.

To apply online:

- Visit our vehicle loan page on the website.

- Select the loan option that fits your needs.

- Complete the online application form.

- Have your personal information, employment details, and vehicle information ready.

- Submit your application and get ready to finalize your loan.

To apply in-branch:

- Visit your nearest branch.

- Bring a valid ID, proof of income, and details about the vehicle you're purchasing or refinancing.

- Our loan specialists will assist you in completing the application and discuss the best loan options for you.

Getting a mortgage is a big step, but we’re here to make it as easy as possible. Whether you're buying a new home or refinancing, our mortgage options are designed to fit your needs. With online and in-branch application options, you’ll be on your way to securing your dream home in no time.

With Nuvision, you have a credit union that is dedicated to building your life!

To apply online:

- Visit our mortgage loan page on the website.

- Choose the mortgage type that best suits your needs.

- Complete the online application with your personal, employment, and financial details.

- Have information about the property you’re purchasing or refinancing ready.

- Submit your application and we’ll help guide you through the next steps.

To apply in-branch:

- Visit one of our branches.

- Bring your ID, proof of income, and any property details or purchase agreements.

- Our mortgage specialists will help you complete the application and explain your loan options.