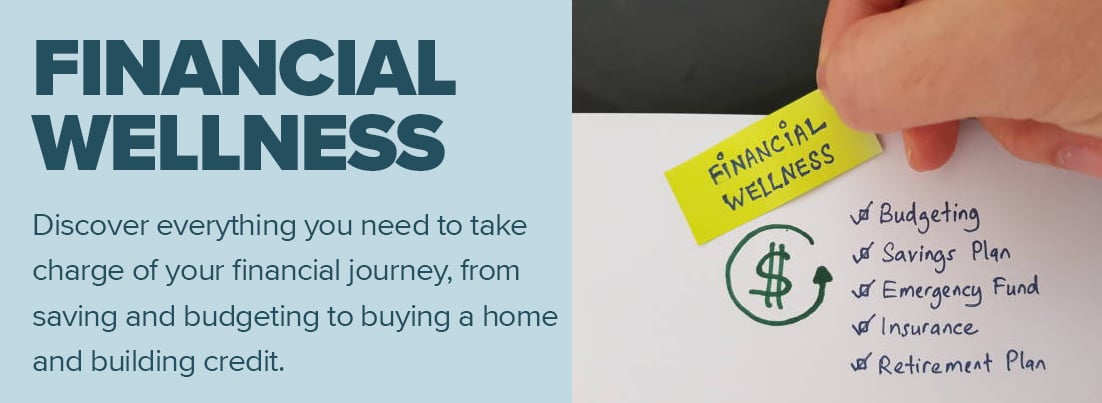

Your Journey to Financial Wellness Starts Here.

Achieving financial wellness isn’t just about saving more or cutting costs—it’s about building the life you want with confidence. Whether you're looking to get out of debt, save for the future, or simply improve your financial habits, we’ve got the resources to help you succeed.

Topics and Resources to Guide You

Financial wellness means having control over your money, feeling secure in your financial decisions, and having the freedom to pursue your goals. It’s about less stress, more peace of mind, and being prepared for whatever life throws at you.

Plan Your Future

Explore our tools to budget, save, and plan your financial future with confidence.

Savings Calculator

Credit Optimizer Calculator

Auto Loan Calculator

Home Loan Calculator

All Calculators

Financial Coaching

At Nuvision, we care about your financial wellness. That’s why we’ve partnered with industry-leading BALANCE to provide you with free access to expertly-crafted financial education and resources to help with your fiscal matters.

Counseling Services

Access to accredited financial counselors that work one-on-one to help you address issues including bankruptcy, debt management, and credit report reviews.

Debt Management

We will help you explore debt management options as a way to eliminate debt. We work with creditors on your behalf to develop a repayment plan.

Free Webinars

Attend free money management webinars. Learn the basics of financial planning, and create a future of security and opportunities.

Nuvision BalanceTrack

Learn the basics of personal finance with the BalanceTrack educational courses. Sign up to access.

MONEY MANAGEMENT FAQS

Opening a checking account is simple! You can visit our website and apply online in just a few minutes. If you prefer, stop by one of our branches, and our team will help you set up your account. You’ll need a valid ID, proof of address, and your social security number to get started.

You have two options for opening a checking account: online or in-branch.

To apply online:

- Visit our website and go to the checking account page.

- Fill out the online application form.

- Have your valid ID, proof of address, and social security number ready.

- Submit your application, and you’ll receive confirmation once your account is set up.

To open an account in-branch:

- Visit one of our locations.

- Bring your valid ID, proof of address, and social security number.

- Our team will assist you with completing the application process.

Want to open your first credit card?

Getting your first credit card is a great way to start building credit and managing your finances. The process is simple, whether you're applying online or visiting a branch. We’ll guide you through every step, so you can get your card quickly and start using it right away.

You can apply for a credit card online or at one of our branches.

To apply online:

- Visit our credit card page on the website.

- Select the card that best fits your needs.

- Complete the online application form.

- Make sure to have your personal information, income details, and social security number ready.

- Submit your application for approval.

To apply in-branch:

- Visit your nearest branch.

- Bring a valid ID, proof of income, and your social security number.

- Our staff will help you complete the application.

Ready to get your first vehicle loan?

Financing your next vehicle is easier than you think! Whether you’re looking to buy a new car or refinance your current loan, we make the process smooth and hassle-free. You can apply online or in-person, and we’ll guide you through each step, so you can hit the road in no time.

To apply online:

- Visit our vehicle loan page on the website.

- Select the loan option that fits your needs.

- Complete the online application form.

- Have your personal information, employment details, and vehicle information ready.

- Submit your application and get ready to finalize your loan.

To apply in-branch:

- Visit your nearest branch.

- Bring a valid ID, proof of income, and details about the vehicle you're purchasing or refinancing.

- Our loan specialists will assist you in completing the application and discuss the best loan options for you.

Getting a mortgage is a big step, but we’re here to make it as easy as possible. Whether you're buying a new home or refinancing, our mortgage options are designed to fit your needs. With online and in-branch application options, you’ll be on your way to securing your dream home in no time.

With Nuvision, you have a credit union that is dedicated to building your life!

To apply online:

- Visit our mortgage loan page on the website.

- Choose the mortgage type that best suits your needs.

- Complete the online application with your personal, employment, and financial details.

- Have information about the property you’re purchasing or refinancing ready.

- Submit your application and we’ll help guide you through the next steps.

To apply in-branch:

- Visit one of our branches.

- Bring your ID, proof of income, and any property details or purchase agreements.

- Our mortgage specialists will help you complete the application and explain your loan options.