Housing Report: Navigating the Housing Market by Debunking Myths and Embracing Realities

For quite some time, economists and a slew of so-called experts have debated what will happen with the US housing, with conflicting narratives now dominating social media platforms and fueling speculation. But it's important to remember that in today's era of YouTube and TikTok videos, almost anyone can call themselves an expert. That's why we bring together some of the top industry analysts and real estate data every month to give you a complete view of what's really going on in the housing market and the economy.

Today, we will examine the housing market's current state and key indicators such as existing-home sales, inventory levels, mortgage rates, and expert opinions. By separating fact from fiction, and giving you access to competing views and opinions, we hope to provide you with a comprehensive look at the housing market's current condition and where it may be heading.

Limited Listings and Fluctuating Mortgage Rates

Existing-home sales in April fell to a seasonally adjusted rate of 4.28 million, down 23.2% compared to April 2022. While the decline is significant, it is important to note that the drop was not as severe as many economists had predicted.

Lawrence Yun, Chief Economist of the National Association of Realtors, acknowledges that the combination of limited inventory, fluctuating mortgage rates, and job gains has created a push-pull effect on housing demand. "Home sales are bouncing back and forth but remain above recent cyclical lows," Lawrence Yun, NAR chief economist, told Fox News.

The Slow but Steady Recovery

Despite the challenges posed by limited listings and mortgage rate fluctuations, many experts say the US housing market is experiencing a broad recovery. In addition, homebuilders have responded to the inventory crunch by increasing the construction of new homes. According to the latest government numbers, both single and multi-family construction rose in April. According to Market Watch, "the strength in new construction comes from strong demand from would-be home buyers who don't have many options in the resale market."

Nicole Bachaud, a Senior Economist at Zillow, highlights that newly built homes will play a significant role in fulfilling the demand due to the scarcity of existing homes. With positive sentiment among homebuilders and increased activity in the spring housing market, the trajectory seems to be upward, ultimately strengthening inventory levels.

Perception vs. Reality

While some social media stars are pushing an impending housing market crash, evaluating the underlying data and expert opinions can help show what's really going on. Steven Thomas, a Real Estate and Housing Marketing Expert, warns against succumbing to baseless narratives fueled by social media stars looking for clicks. He highlights that these so-called social media experts often lack economic credentials and overlook essential facts. In addition, these narratives can mislead potential buyers and perpetuate an unfounded fear of the housing market.

"From YouTube to TikTok to the backyard barbecue, there are plenty of narratives regarding the pending doom for housing that the underlying data does not support. The best advice in hearing all the talk swirling around the belief that a real estate crash lurks around the corner is to ignore the noise and stick to the facts," says Steven Thomas.

Real Estate as a Long-Term Investment

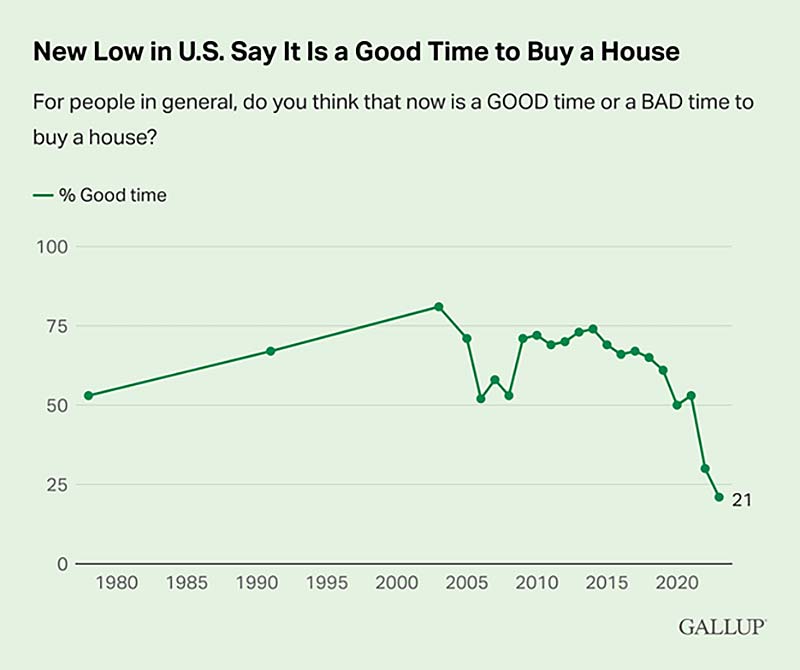

According to a Gallup poll, only 21% of US adults currently believe it is a good time to buy a house, representing a decline of 9 percentage points from the previous year.

However, it is important to note that despite this decline, their poll also showed that real estate continues to be regarded as the best long-term investment option compared to stocks, gold, and other alternatives.

As you look for information on the current state of the US housing market, it is important to separate the facts from the fiction pushed on social media. Limited listings and fluctuating mortgage rates have presented challenges, but market experts are saying that they are not stopping a broader housing market recovery. Therefore, buyers, sellers, and consumers need to base their expectations on factual data rather than sensationalized narratives. By dispelling misconceptions and embracing reality, prospective buyers and sellers can make informed decisions that will help them navigate the current housing market.