Watch Out for Credit Repair, Credit Card, and Debt Relief Scams

There are about 270 million registered vehicles in the United States. Estimates show that there are about 225 million smartphone users in the U.S. In 2015, the most recent year for which IRS information is available, more than 140 million taxpayers filed federal income taxes. The U.S. Department of Education’s National Center for Education Statistics reported that about 20 million students are enrolled in American colleges and universities.

In terms of pure opportunity for fraud, scams, identity theft, nothing beats credit cards – and the accompanying debt. The sheer number of credit card accounts and consumers represents a potential goldmine for criminals and thieves.

It’s likely that nothing you use or carry with you on a daily basis makes you more vulnerable to crime, offers more risk for fraud, or creates more chances to become a victim than your credit card.

This isn’t a plea to cut up your card. In fact, with new technology and changes in the credit card industry, more fraud awareness, and better ways to monitor your accounts, using a card is generally safer than ever. Based on the sheer number of cards, your chance of becoming a target are very small. But the raw numbers are big, and that’s why it is important to remain vigilant and educated about credit repair, credit card, and debt relief scams.

Opportunity for fraud

Students were the, “least concerned yet most severely impacted by fraud,” in a study about fraud and identity theft. Numerous tax scams target tax filers with W-2 spear phishing attacks and other types of tax-related identity theft. Mobile phone users can become the victim of phone number spoofing and payment services fraud and text message phishing. Applying for an auto loan on an unencrypted website can put your personal and financial information at risk, while unscrupulous actors take advantage of those who want better terms for their auto loan.

All of those groups are targets for cybercriminals, scams, and fraud. But they pale in comparison to the opportunity presented by credit card users.

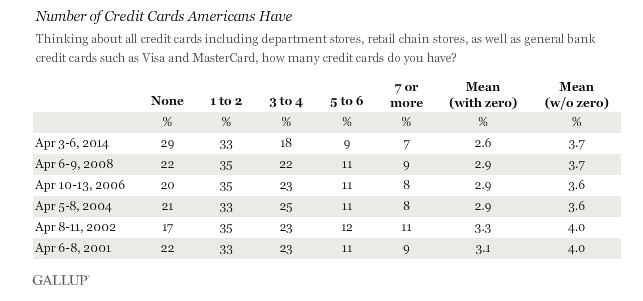

According to the American Bankers Association, there were 364 million open credit card accounts in the United States at the end of 2017. And that number continues to increase. There were 4.1 percent more credit card accounts than one year earlier and the number of open credit card accounts has increased every year since 2012.

CreditCards.com says that about 7 in 10 Americans have at least one credit card. The Boston Federal Reserve said three-quarters of Americans have a credit card account. CreditCard.com calculated, “Using the Census Bureau estimate of 249.5 million adults in the U.S., that means there are about 189 million Americans adults with at least one credit card.” More than one-third have three or more credit cards.

Credit card fraud

When most of us think of credit card fraud, we think about a thief illegally obtaining our card information and using it to make a purchase without our permission. That can happen if someone steals your wallet, if someone obtains your login information, if your online account is hacked, or if a company loses information in a data breach.

Of course, all of that happens. But there are many ways you can protect your credit card account from fraud. A White Paper available from Credit Union Journal offers the following suggestions:

- Keep a close eye on your account activity. Set up suspicious account activity alerts to notify you when a transaction occurs that may be fraudulent.

- Designate one credit card to use for online purchases. If there is fraudulent activity on this card, you will still be able to use your other cards.

- Take advantage of any security tools offered by your credit union such as the ability to turn cards on and off, set transaction-based alerts, and deny transactions based on set criteria.

- Set daily card limits to prevent large fraudulent purchases from being made.

- Protect your information online: clear passwords, make new passwords, be alert for phishing emails in which spam messages or pop-ups try to get you to enter credentials.

- Don’t carry all your cards at once so that, if your wallet is stolen, you aren’t left without payment options.

- Keep up-to-date on fraud trends and news to know how to continue to best protect yourself.

Credit repair scams

CNBC reports that the average American has a credit card balance of more than $6,300. Wouldn’t it be nice if someone could just make that disappear? There are some who promise that they can, but it could be part of a disappearing money scam.

Debt.com warns consumers to be wary of credit repair promises:

How Credit Repair Promises Work: You will find companies that promote their ability to remove negative credit information from someone’s history (even if it’s accurate information). According to the Federal Trade Commission (FTC), such claims are illegal.

How to Avoid Credit Repair Promises: There’s only one cure for a bad credit score — time, persistence and an honest effort to pay your bills on time. If there is incorrect negative credit information on your credit report, it can be addressed directly by contacting the credit agencies. Be sure to recognize the credit repair scams warning signs.

The FTC also has pages on its website dedicated credit repair scams that promise a, “new credit identity.” According to the agency, you can spot signs of a credit repair scam if a company:

- insists you pay them before they do any work on your behalf;

- tells you not to contact the credit reporting companies directly;

- tells you to dispute information in your credit report — even if you know it's accurate;

- tells you to give false information on your applications for credit or a loan; or

- doesn’t explain your legal rights when they tell you what they can do for you.

If you’re having trouble with credit card debt, please contact your financial institution. Nuvision will always work with its members to try to find a solution. If you are a member, please contact us online, schedule an appointment, or visit us at a branch.

You can also find information on from FTC about how to deal with debt and repair your credit.

Phony debt relief

The FTC announced in July that it was going to mail

nearly 600 checks totaling almost $185,000 to people who were tricked

into paying phony debts. That’s one of dozens

of enforcement actions the FTC has taken recently against debt relief and

credit repair scams, which it

said, “led to more than $6.4 billion in refunds for consumers in a one-year

period between July 2016 and June 2017.”

Debt relief is often confused with other similar-sounding

terms. The terms “credit counseling,” “debt relief,” “debt consolidation,” and

“credit repair” are often misunderstood. The Better Business Bureau provides a summary

that explains the differences.

In all cases, one red flag that signals potential fraud

is when a company charges a fee before debit is settled.

Ask for help and report suspicious activity

Again, if you believe you’re a victim of credit card

fraud, a credit repair scam, or phony debt relief, ask for help and report

suspicious activity. Don’t hide. Contact Nuvision, which works with its members

to find solutions to all their financial challenges.

Alternatively, you can file a complaint with

the FTC, which says, “Complaints from consumers help us detect patterns of

fraud and abuse.” The same goes for Nuvision, which works with law enforcement

to report suspected fraud, identity theft, and scams.

The more you communicate with your financial institution,

the better it is for all consumers.

Fraud trends and news

Nuvision is your credit union resource for alerts, news,

and information about fraud, identity theft, financial and data protection, and

cybersecurity. Learn about fraud protection and

follow Nuvision on Facebook

and Twitter to receive updates

when new articles are published.