What is a Credit Report, and Why Does it Matter?

Ever wonder what your credit report is and why it’s so important? Your credit report is essentially a record of your financial history with credit. This report is what banks, lenders, employers, landlords, and even insurance companies may use to make decisions about you. Here’s a closer look at how it works and why it matters.

Breaking Down Your Credit Report

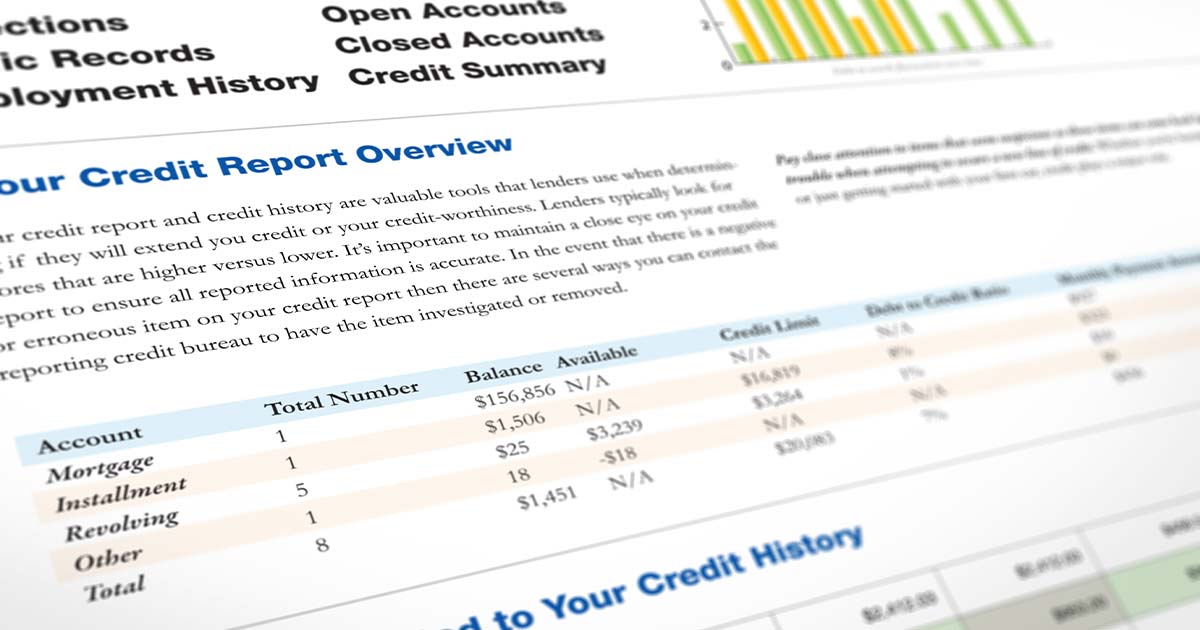

At its core, a credit report is a detailed record of how you've handled credit in the past. It shows whether you’ve paid on time, missed payments, or defaulted on a loan. Different types of credit are reported here, including credit cards, personal loans, mortgages, car loans, and student loans. However, non-credit bills, like utilities, don’t usually appear unless they’ve gone unpaid and sent to collections.

Three major credit bureaus—Equifax, Experian, and TransUnion—collect, maintain, and share this information. Lenders and other parties report your credit activity to these bureaus, usually monthly. But keep in mind, not every lender reports to all three, which is why your reports can differ slightly between bureaus.

What’s Included in a Credit Report?

Credit reports contain four main sections:

Personal Identification: This part includes your name, address history, and sometimes employment history. It helps verify that the report belongs to you.

Trade Lines (Credit Accounts): This is the bulk of the report. It details your credit accounts, including credit limits, balances, and payment patterns over the past couple of years.

Public Records: Here you’ll find records that might impact your credit, such as bankruptcies, tax liens, and foreclosures. These can stay on your report for years and significantly impact your creditworthiness.

Inquiries: This section tracks who has looked at your credit report. There are “hard inquiries” (from applications for credit) that can impact your score slightly, and “soft inquiries” (like those from personal checks or pre-approval offers) that don’t affect your score.

Credit Report vs. Credit Score

While your credit report details your history, your credit score is a number that summarizes it. Scores range from 300 to 850, with higher scores generally indicating more favorable creditworthiness. Factors like payment history, amounts owed, credit history length, types of credit, and new credit applications all influence your score. A high score usually means better interest rates, while a low score can limit your options.

Why Is a Credit Report Important?

Your credit report is used by:

- Lenders: They’ll check your report when you apply for a loan or credit card to determine approval and set interest rates.

- Insurance Companies: They may review it when deciding whether to insure you and to set premiums.

- Employers: Some employers check credit reports as part of the hiring process.

- Landlords: Landlords may use your report to evaluate if you’re likely to pay rent on time.

Checking Your Credit Report Regularly

Errors on your credit report can lower your score and cost you money. That’s why it’s important to check your report regularly. You can dispute inaccuracies with the credit bureau to keep your report accurate.

Building or Rebuilding Credit

If you’re just starting out or rebuilding your credit, certain types of credit cards, like Nuvision Credit Union’s Visa® Share Secured Card, can be a helpful tool. This card allows you to build credit without high rates or extra fees, making it a great option to start improving your credit health responsibly.

In short, your credit report reflects your financial reliability. A strong credit history opens doors, while a weak one can limit your options. By staying on top of your credit report, correcting errors, and using credit responsibly, you can set yourself up for a solid financial future.