Black Friday, Cyber Monday and Gift Card Fraud Can Make for Unhappy Holidays

Follow some basic guidelines to steer clear of cybercriminals, crooks and

thieves

The great holiday shopping season kicks off this week with Black Friday and continues through Cyber Monday. And if last year was any indication, then 2018 is shaping up to be a massive opportunity for cybercriminals, crooks and thieves.

While many of us will brave the crowds and visit a mall or outlet, others will start their gift-buying online. Most shoppers now do a combination of both.

It’s not hard to shop safely, but the bad guys are always on the lookout for shoppers who may be inattentive or lazy because they can be easy targets for holiday fraud, phishing and scams. Follow some basic guidelines, however, and you can feel much more comfortable about having happy holidays.

Busy shopping weekend

Last year, the National Retail Federation predicted that about 164 million consumers would shop in person or online over the unofficial start to the holiday shopping season. That estimate turned out low. The NRF reported than more than 174 million Americans shopped in stores and online from Black Friday through Cyber Monday. That means nearly three-quarters of American adults shopped online or in person over Thanksgiving weekend.

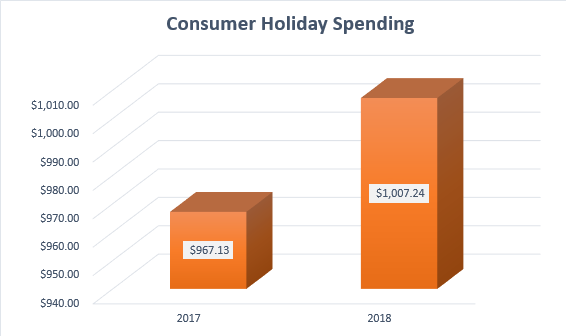

Of course, Thanksgiving weekend accounts for only a portion of overall holiday shopping. In 2017, Americans spent $335 over the five-day weekend, but consumers planned to spend about $967 during the entire holiday season. This year, the NRF annual holiday shopping survey shows that consumers will spend over $1,000, which is a 4.1 percent increase over 2017.

Data from National Retail Federation and Prosper Insights & Analytics

Fraud and online shopping

Online shopping is extremely convenient and often

now preferred to visiting brick-and-mortar stores. In fact, TheStreet.com

reported that online sales on Cyber Monday last year accounted for

$2.7 billion in sales taxes compared to $1.3 billion on Thanksgiving, $1.97

billion on Black Friday, and $2.5 billion on the Saturday and Sunday after

Thanksgiving.

- 8 percent of consumers reported being a victim of identity theft during the holiday season.

- 43 percent of consumers who had their identity stolen say it happened while shopping online during the holidays.

FRAUD TIP:

|

Malicious apps

Holiday shopping is also a magnet for cybercriminals looking to cash in on fraudulent digital and mobile technology. For example, researchers found hundreds of malicious apps pretending to offer discounts, according to CNET:

Researchers looked up "Black Friday" in app stores, and found that 237 of 4,324 results were malicious, and 44 out of 959 "Cyber Monday" apps were also malicious, RiskIQ said. For the top 10 retailers of Black Friday in 2017 -- which RiskIQ declined to name -- researchers found 6,615 malicious apps pretending to offer deals.

FRAUD TIP: Download apps only from Google Play and the App Store on iTunes. Shopping apps may need you to create a password, but be wary of an app if it asks for contacts, login or password from other accounts or apps. |

Gift card scams

Gift card scams come in different shapes and sizes. For example, the Chicago branch of the Better Business Bureau was targeted. One of the employees received an email that appeared to be from her boss, the head of the Chicago BBB. The email asked her to purchase gift cards for the rest of the employees of his office. She became suspicious and reported it to her boss, but this is a common scam that only needs a fraction of recipients to fall for it in order to be successful.

Fraud.org reported that it has seen, “spike in news reports about gift card scams.” A recent gift card scam alert noted:

A typical scam scenario begins with a consumer receiving a gift card as a present from a friend, colleague, or loved one. When the recipient goes to use the card they assume is loaded with funds, the card gets declined. Unbeknownst to the gifter or the card recipient, before the card’s purchase, a scammer had taken the card off the rack at a retail location, copied down the card number, scratched off and recorded the security codes on the back of the card, and once the card was activated, drained its funds via online purchases.

FRAUD TIP:

|

Shop on a secure website

Shop on a secure website – this is as elementary as it gets. Patrick Nohe, the editor-in-chief for cybersecurity website Hashed Out, wrote in a recent post:

As of July 2018, the entire internet should be using HTTPS. It should be the default setting now. The baseline. So any website that you arrive at that isn’t using HTTPS – especially in the context of holiday shopping – is not providing a safe online shopping experience and should be categorically distrusted.

Importantly, Nohe notes, HTTPS isn’t foolproof. “While HTTP is categorically bad, HTTPS is not categorically good.” Look for clues to a dubious website.

FRAUD TIP:

|

SEE: 5 Ways to Determine if a Website is Fake, Fraudulent, or a Scam - 2018

Keep antivirus software current and report fraud

Finally, make sure your antivirus software on your computer is up-to-date. If you become a victim of online shopping fraud, file a complaint with:

- the Federal Trade Commission at https://www.ftccomplaintassistant.gov/;

- your state attorney general, using contact information at naag.org;

- your county or state consumer protection agency. Check the blue pages of the phone book under county and state government, or visit consumeraction.gov and look under "Where to File a Complaint"; or

- the Better Business Bureau.

Stay on top of fraud trends and news

Nuvision is your credit union resource for alerts, news, and information about fraud, identity theft, financial and data protection, and cybersecurity. Learn about fraud protection and follow Nuvision on Facebook and Twitter to receive updates when new articles are published.