Important Merger News -- An Exciting Future as Nuvision Credit Union!

We are very pleased to announce that the membership of Paradise Valley Federal Credit Union resoundingly approved a resolution to merge with Nuvision Credit Union on April 18, 2024. Thank you to all the members who made your voice heard through your vote.

Paradise Valley and Nuvision share a long history of making a positive difference in the lives of members. Through this partnership, we’re honored to continue that legacy and bring you and your family the best value for your membership with many new benefits.

Merger Documents and Information

Member welcome letter

Nuvision Welcome Guide

digital banking faqs

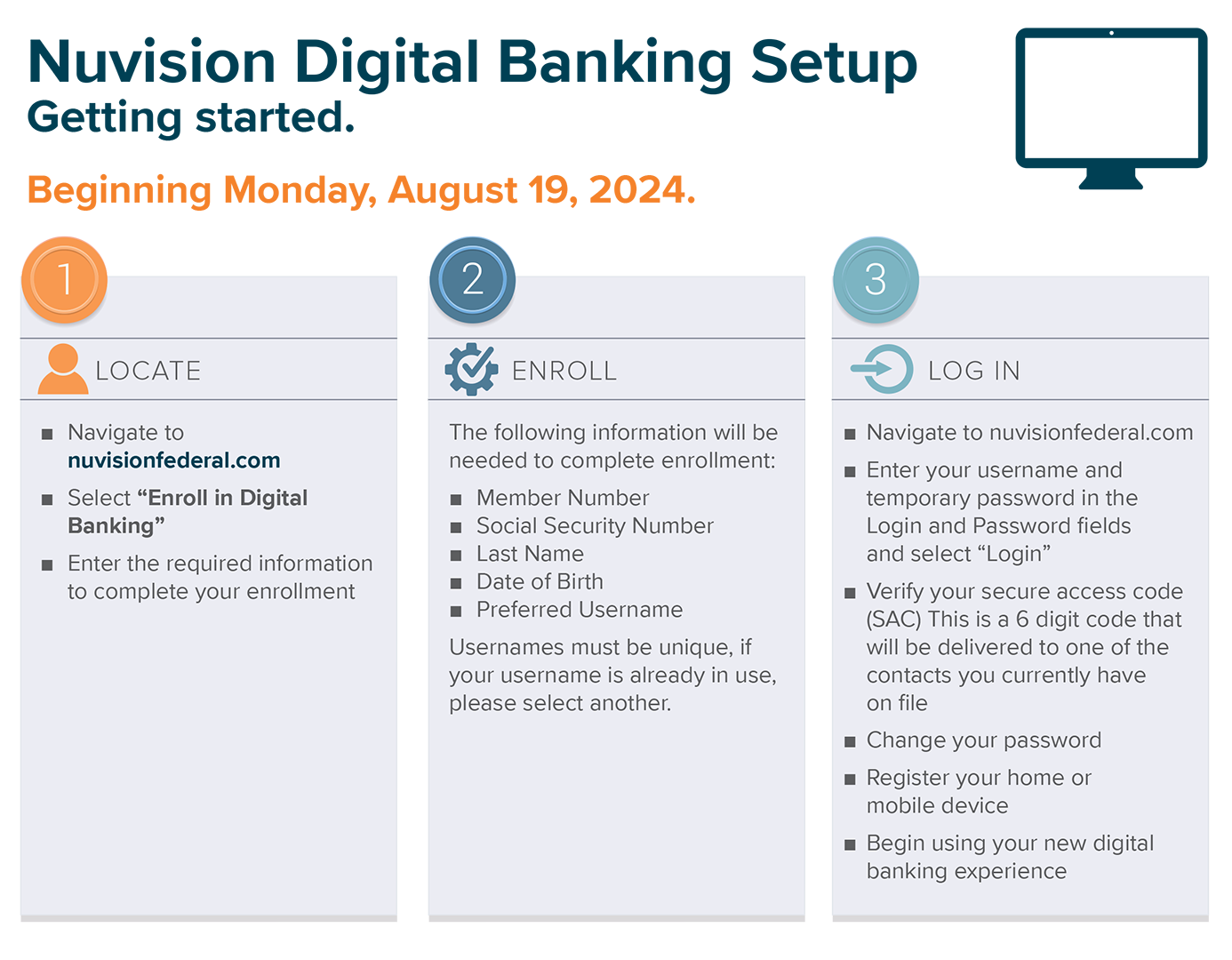

Digital banking instructions

Recurring Payment Letter

Dual Insurance Information

FAQs

Member Contact Center hours are Monday – Friday 7am to 7pm PST and Saturday 9am – 2pm PST.

Live Chat is Monday - Friday 9am to 5 pm PST.

No, the branch hours will not change on August 19.

National City Branch hours will remain Monday – Friday 9am to 5pm PST.

Santee Branch hours will remain Monday - Friday 10am to 4pm PST (Closed 1p-2p)

Both branches are closed on Saturdays.

Yes, your routing number will change, and your account number will be a 12-digit account number. We will honor and clear any outstanding Paradise Valley Federal Credit Union (Paradise Valley) checks that have been written until April 19, 2025. Members must order new checks with their new account & routing numbers soon after August 19.

Any outstanding Paradise Valley checks will continue to be honored and clear until April 19, 2025. At the earliest convenience members should order new checks with the new routing and account number.

Yes, if you have written checks in the past three months, you will receive a letter that will include three checks.

Yes. Simple Free Checking and Young Adult Checking (members 13-23 years of age) are both maintenance fee free.

ACH and Direct Deposit (Payroll Deposits and Government issued benefits, such as Social Security, Disability, etc.) will continue to process without interruption until April 19, 2025; However, it is required to update your (Payroll Deposits and Government issued benefits, such as Social Security, Disability, etc.) with your new account and routing number prior to this date to avoid a disruption in service.

No, all recurring payments set up on the Paradise Valley’s ‘Make a Payment’ portal will no longer be active effective August 1, 2024. Members that have payments due between August 1st & August 13 can make a one-time payment through the same portal on the Paradise Valley website. Members can log on to their accounts and click “Transfer & Payments” at the top then transfer from Debit Card or e-Check. Members can also call Paradise Valley for additional support at 619.475.4313.

Beginning August 19, members can set up one-time payments or recurring payments through Nuvision’s EZPay Portal, located on the website - Make a Payment (nuvisionfederal.com). Payment options include ACH and Debit Cards.

Contact our Member Contact Center at (800) 444-6327 for additional guidance.

For assistance on any loan delinquency, please contact our Collections Department at (866) 617-8517.

Access to Bill Pay will require enrollment in the Nuvision Bill Pay service. Any previous Bill Pay history should be downloaded from your Paradise Valley bill pay site prior to August 17, 2024.

Yes. Please download any information you want to transfer to your new bill pay prior to August 17, 2024.

Existing Paradise Valley Bill Payment will continue to work through Friday, August 16, 2024. Members should make a copy of list of payees. Beginning Monday, August 19, 2024, members will need to re-establish their payees after they have registered with Nuvision’s Bill Pay service. Once they have successfully registered for Nuvision’s Digital Banking, they can enroll in Bill Pay. They can click on the Bill Pay tab and follow the instructions to add payees.

No, the Annual Percentage Rate will remain unchanged.

No, current due dates will not change with the new Nuvision credit card.

Credit Cards

- Classic Rewards Visa points will not be carrying over to your Nuvision Platinum Rewards credit card. Classic Rewards Visa points will stop accruing on 7/31/2024. Classic Rewards Visa points must be redeemed by 8/9/2024, otherwise the points will expire. You will begin to accrue your new rewards points on 8/16/2024 on purchases made with your Nuvision Platinum Rewards card.

- For the month of August, the billing cycle for credit cards will be moved from the 12th to the 15th.

- For the month of September, the payment date for credit cards will be moved from the 9th to the 12th.

- Please see the Credit Card section of the member packet for ongoing billing and statement cycles.

Debit Cards

- Rewards points on your Visa Debit Card will not be carrying over to your Nuvision Visa Debit Card. Rewards points on your Visa Debit Card will stop accruing on 7/31/2024. Rewards points on your Visa Debit Card must be redeemed by 8/9/2024, otherwise the points will expire.

Debit cards are expected to be received no later than August 16 and credit cards no later than August 15.

Paradise Valley debit cards can continue to be used through end of day Sunday, August 18, but they will not be able to view balances or make deposits through the ATM beginning Friday, August 16 due to the conversion.

Nuvision debit cards can be activated beginning Monday, August 19 by calling 866-985-2273. PIN numbers can be established at time of activation.

Paradise Valley credit cards can continue to be used through end of day Thursday, August 15.

Nuvision credit cards can be activated on Friday, August 16.

Note: credit card limits may be limited due to conversion between Friday 8/16 and Monday 8/19

During conversion weekend, members can contact Paradise Valley directly at (855) 789-8189 for assistance.

To access this information, members must enroll in digital banking and opt-in to receive eStatements beginning August 19, 2024. Once enrolled, members can pull copies of eStatements through digital banking.

Only new transactions beginning August 19 from your Nuvision account will be displayed in the transaction history within digital banking.

Born nearly a century ago as the credit union of Douglas Aircraft, our values were forged in the factories and plants that made the region prosper. Helping build the lives of hard-working people has been our mission since the day we were founded. Nuvision Credit Union is here to provide you with specialized products, expert service, and financial tools to help you with the life you build.

Headquartered in Huntington Beach, CA, Nuvision FCU (www.nuvisionfederal.com) is a federally chartered, full-service credit union serving more than 160,000 members in California, Arizona, Washington, Alaska and Wyoming with assets of approximately +$3.4 billion.

The merger between Nuvision and Paradise Valley Federal Credit Union (PVFCU) will bring greater value and convenience from your credit union membership. After our credit unions are integrated, members will receive an important number of additional benefits:

Added Convenience and Access

- More locations for your convenience. There are 14 NEW shared branches in San Diego and the addition of the shared branch network. There are over 5,000 branches nationwide that will be available for members to bank at.

- Forty-nine proprietary ATMs available to members as well as the addition of the CO-OP Network of ATMs which provide fee-free access to 30,000 CO-OP ATMs nationwide.

- A toll-free, full-service contact center with extended weekend hours and live chat to assist members who prefer the convenience of banking by phone or online.

New Products and Services

- Mobile Banking, including text messaging and mobile check deposits

- Online banking including bill pay

- Investment services

- Credit cards

- Zelle transfer services

- Expanded in-house real estate services

- Business services, including commercial and business lending and business deposit services

- Added Advantage Loyalty member program that provides additional valuable fee waivers and rate incentives

Absolutely! Both Credit Union Boards are very excited about this partnership and the benefits it brings our members and communities.

With the member approval process now completed, we will begin integrating the operations of the two credit unions, which is targeted for completion by August 19, 2024. We will keep you updated on our progress in the coming months.

Members can feel very at ease with the financial stability of this merger, as both credit unions are independently successful, strong, and financially sound. We each have net worth ratios that exceed regulatory requirements to qualify as well capitalized, and both have avoided high-risk lending activities.

The name of our combined organization will be Nuvision Credit Union.

We’ve ensured that this is an easy transition for you. You will not need to open a new account. As we integrate our systems, all existing PVFCU accounts will automatically be migrated onto Nuvision Credit Union’s system. We will work hard to make the integration as seamless as possible so that you may continue to conduct business as you always have.

Yes. We will provide you more specific information about your account number when we integrate our credit union systems.

You will begin to receive information as we get closer to system integration, which is scheduled for August 19, 2024. As we get closer to this date you will receive a number of communications that will have important information regarding your accounts.

Many of the current products that you enjoy at PVFCU are also available at Nuvision. You’ll be provided with more information as we combine the two credit unions. Existing certificates and IRA certificates will retain the same rates and maturity dates.

Yes, this information will be transferred to and recognized by Nuvision’s data processing system.

Nuvision Credit Union CEO Roger Ballard will remain CEO of the combined organization. The same team from PVFCU will continue to serve members at the National City and Santee branches after the merger.

Yes! Your accounts will remain safe, sound and federally insured through the National Credit Union Share Insurance Fund, a U.S. Government Agency, just as they are today.

Yes, of course! You will absolutely continue to receive the same personalized service you’ve come to expect from us. In fact, we’ll have the resources to offer you even better service. The primary reason for our two credit unions to explore this merger is to better serve our member-owners.

No, membership eligibility will not be affected. The combined credit union will continue to serve all of the organizations, companies and sponsors we currently serve. It will also provide credit union membership opportunities to new communities and members that we have been unable to serve in the past.

We’re here to answer your questions! Please don’t hesitate to call (800) 444-6327 (Nuvision members) or [email protected] (PVFCU members) if you have any questions about this partnership and what it means to you.