Digital Banking FAQs for Paradise Valley Merger

Nuvision Digital Banking Setup

BEGINNING MONDAY, AUGUST 19, 2024.

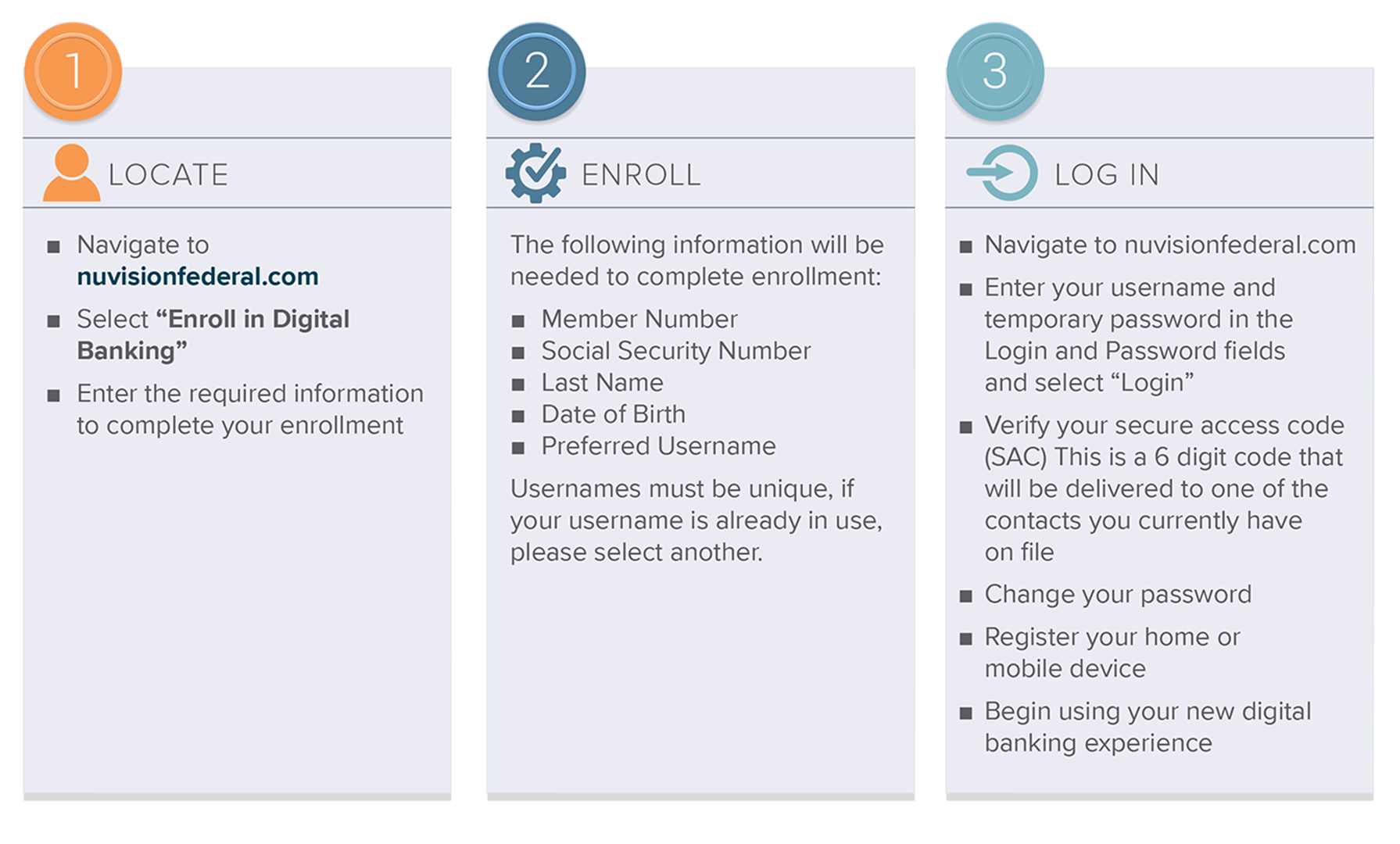

To enroll in Digital Banking, follow the steps below or start by clicking here.

Enrollment and Login

WILL I NEED TO RE-ENROLL IN DIGITAL BANKING?

Yes. Enrollment in digital banking will need to be completed to access your accounts and services online.

WHEN WILL DIGITAL BANKING BE AVAILABLE?

Digital Banking enrollment will be available on August 19, 2024

HOW DO I ENROLL IN DIGITAL BANKING?

Select the “Enroll in Digital Banking” option from the home page of www.nuvisionfederal.com or click here.

WHAT INFORMATION DO I NEED TO ENROLL IN DIGITAL BANKING?

At the time of enrollment, the following information will be required:

- Member #

- Social Security Number

- Last Name

- Date of Birth

CAN I USE THE SAME LOGIN ID I HAD BEFORE?

Every Login ID must be unique, if your previously used ID is available then you will be able to use it at the time of enrollment. If the ID is already in use, then you will receive a prompt at enrollment and a new ID will need to be selected.

IF I HAVE ISSUES ENROLLING, WHO CAN I CONTACT FOR ASSISTANCE?

Please reach out to us at 800-444-6327 and ask to speak with an agent or visit any of our branch locations.

Access to Account History and Statements

WILL I HAVE ACCESS TO THE HISTORY OF MY ACCOUNTS AFTER ENROLLMENT?

Account history prior to August 17, 2024 will be accessible through paper statements or e-Statements. All activity on your accounts after August 17 will be available in the transaction activity for each account as well as future e-Statements. One year of statements will be available through e-Statements at the time of enrollment.

HOW FAR BACK WILL E-STATEMENTS BE AVAILABLE AT THE TIME OF ENROLLMENT?

One year of statements will be available through e-Statements at the time of enrollment.

HOW DO I REQUEST STATEMENTS THAT DO NOT DISPLAY THROUGH DIGITAL BANKING?

There are multiple options for requesting statements not available online:

- Use the Statement Request Form available through digital banking to request all your account statements during a specified period of time

- Contact us by phone at 800-444-6327 and ask to speak with an agent

- Visit any of our branch locations

WILL THERE BE ANY COST FOR REQUESTING OLDER STATEMENTS?

Fees for statement copies will be waived for the first year, beginning August 17, 2024.

Available Accounts Through Digital Banking

WHAT TYPE OF ACCOUNTS WILL BE AVAILABLE WHEN I ENROLL IN DIGITAL BANKING?

Checking, Savings, Certificates, and all non-mortgage loans will be immediately available upon enrollment. Credit Cards will be available on or after August 22. Mortgage loans will be available on or after August 26.

WHO CAN I CONTACT WITH QUESTIONS ABOUT MY MORTGAGE LOANS BEFORE THEY ARE AVAILABLE THROUGH DIGITAL BANKING?

For questions or assistance on your mortgage loans prior to availability online, please contact 844-324-7796 option 1.

WILL I HAVE THE ABILITY TO MANAGE MY DEBIT AND CREDIT CARDS THROUGH DIGITAL BANKING?

Yes. Both debit and credit cards under your SSN will be available under the Card Management feature.

WILL I HAVE ACCESS TO BILL PAY AND MY PREVIOUS BILL PAY HISTORY THROUGH DIGITAL BANKING?

Access to Bill Pay will require enrollment in the Nuvision Bill Pay service. Any previous Bill Pay history you require, should be downloaded from your Paradise bill pay site prior to August 17, 2024.

WILL I NEED TO RE-ADD MY BILL PAY RECIPIENTS?

Yes. Please download any information you want to transfer to your new bill pay prior to August 17, 2024.

Money Movement Services

WHAT MONEY MOVEMENT SERVICES WILL I HAVE ACCESS TO THROUGH DIGITAL BANKING?

We currently offer the following money movement options:

- Internal Transfers (transfers between accounts on your profile)

- External Transfers (transfers to external accounts in your name)

- Member to Member Transfer (transfer to another member within Nuvision Credit Union)

- Zelle®

- Wires

- Bill Pay

- Credit Card Payments

- Loan Payments

- Mobile Deposit

CAN I CONTINUE TO USE THE ZELLE APP AFTER THE MERGER?

Beginning August 17, 2024 the Zelle app will no longer work with your debit card. Zelle access will now be through digital banking and will require re-enrollment in the Zelle services.

WHEN CAN I ENROLL IN ZELLE?

Zelle access is available one day after enrollment in digital banking. (e.g. Enroll in digital banking on August 19 and Zelle enrollment is available August 20)

WHAT ARE THE CUT-OFF TIMES FOR SAME DAY ACH AND WIRE PROCESSING?

Both ACH and Wires have a cut-off time of 12:30 PM PT for processing a transaction during the current business day. Any transactions initiated after the cut-off will be processed the following business day.

DO YOU SUPPORT INTERNATIONAL WIRES THROUGH DIGITAL BANKING?

At this time, only Domestic Wires are offered through digital banking. International wires may be completed through any of our branch locations.

DOES NUVISION OFFER A MOBILE BANKING APP?

Yes. The Nuvision mobile app is available for download in both the Apple and Google Play store through your Apple or Android mobile devices.

IS THE MOBILE APP ONLY AVAILABLE FOR PHONES?

The mobile app is accessible on both phones and tablets for Apple and Android, and is also compatible with Apple Watch.

DOES THE MOBILE APP SUPPORT BIOMETRIC AUTHENTICATION?

Yes. The mobile app will support the biometric authentication methods offered by the type of phone or tablet used for login. If you do not wish to use biometrics, a four-digit PIN may be established as a substitute security measure.

WHAT SUPPORT OPTIONS ARE AVAILABLE FOR DIGITAL BANKING?

We offer multiple options for digital banking support. Both Secure Messaging and Chat allow for you to reach out while in an active session. You may also contact us by phone at 800-444-6327 or visit any of our branch locations.