How will members benefit?

This merger will bring you greater value and convenience from your credit union membership. After our credit unions are integrated, members will receive the following benefits:

- 12 additional branches and the addition of the shared branch network. With a combined credit union, members will have access to a total of 13 branches in Los Angeles and Orange County (one limited access branch is located in Mesa, AZ). NuVision Federal Credit Union will maintain the existing branch in Mission Hills. In addition, as part of the shared branch network, there are over 5,000 credit union branches nationwide that will be available to members for access to their credit union accounts -- that adds up to convenience comparable to the country’s largest banks.

- Saturday hours at seven branch locations, and extended weekday hours (see below for branch hours of operation).

- Twenty-three proprietary ATMs available to members as well as the addition of the CO-OP Network of ATMs which provide free access to 30,000 CO-OP ATMs nationwide.

- A toll-free, full service contact center with extended weekend hours and live chat to assist members who prefer the convenience of banking by phone or over the internet.

The Board of Directors believe that members will have access to a much more comprehensive array of products and services to bring even more value from their credit union at highly competitive rates, including:

- Mobile Banking, including text messaging and mobile check deposits

- Comprehensive online banking including bill pay

- Investment services

- Credit cards

- Expanded in-house real estate services

- Business services, including commercial and business lending and business deposit services

- Added Advantage program that provides additional fee waivers and rate incentives

Who is NuVision Federal Credit Union?

Headquartered in Huntington Beach, NuVision FCU (www.nuvisionfederal.org) is a federally-chartered, full-service credit union serving more than 80,000 members with assets of approximately

$1.5 billion and a strong capital ratio of about 12%. Founded in 1935 to serve employees of Douglas Aircraft Company, NuVision FCU has evolved to serve aerospace employees (primarily from Boeing) as well as The Gas Company and community members in

Southern California, with an emphasis on Los Angeles and Orange Counties. The credit union has 12 branch locations primarily in Los Angeles and Orange Counties (with one in Mesa, AZ) and approximately 260 employees.

Do both credit unions support this partnership?

Absolutely! Both Boards are very excited about this partnership and the benefits it brings our members and communities.

What is the merger process and timeline?

We have completed due diligence to make sure this merger provides our members with significant benefits above and beyond what they have today. We have also received approval from our regulators. The final decision is now up to our members, and we hope

you give your approval to this exciting partnership. Assuming all approvals are received, we will begin integrating the operations of the two credit unions, which is targeted for June 2017. We will keep you updated on our progress in the coming months.

Are both credit unions financially sound?

Both credit unions are independently successful, strong and financially sound. We each have net worth ratios that exceed regulatory requirements to qualify as well capitalized, and have both avoided high-risk activities, such as sub-prime mortgage lending.

What will the name of the new organization be?

The name of our combined organization will be NuVision Federal Credit Union.

Will I need to open a new account with NuVision?

You will not need to open a new account. As we integrate our systems, all existing American FCU accounts will automatically be migrated onto NuVision FCU's system. We will work hard to make the integration as seamless as possible so that you may continue

to conduct business as you always have.

Will my member number change?

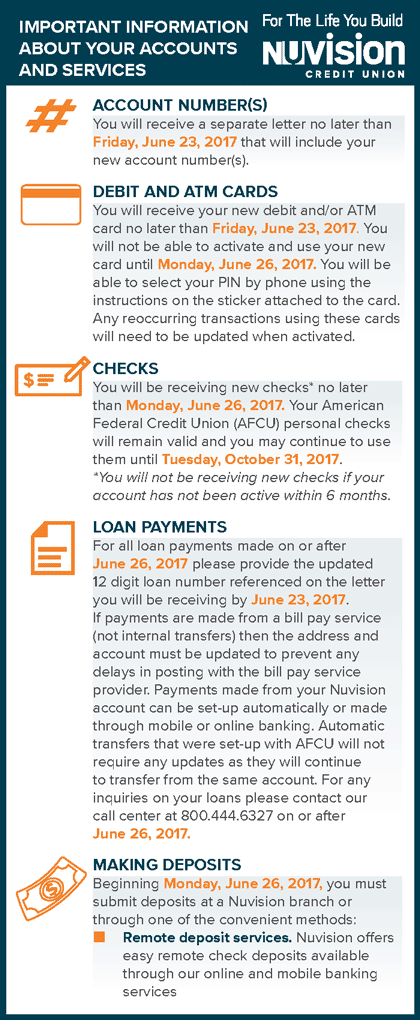

Yes. We will provide you more specific information about your account number when we integrate our credit union systems.

How will I receive information about my new NuVision member number?

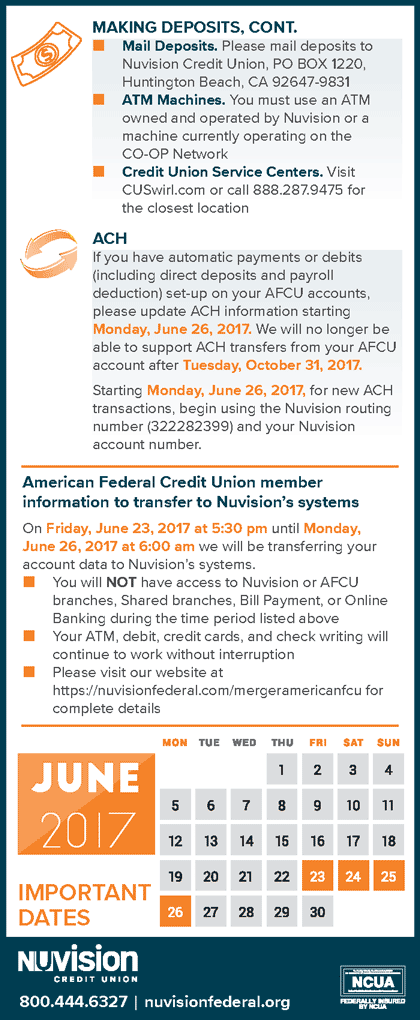

You will begin to receive information when we get closer to system integration, which is scheduled for late June 2017. As we get closer to this date you will receive a number of communications that will have important information regarding your accounts.

Will my existing accounts still be available as a NuVision member?

Many of the current products that you enjoy at American FCU are also available at NuVision FCU. You’ll be provided with more information as we combine the two credit unions. Existing certificates and IRA certificates will retain the same rates and

maturity dates.

Will American FCU members retain their membership open date?

Yes, this information will be transferred to NuVision FCU’s data processing system.

Will I have to order new checks?

You will be receiving new checks with your new account number. You will able to continue to use your American FCU checks until 9/30/2017.

Who will lead the new organization?

NuVision CEO Roger Ballard, will remain CEO of the combined organization. The same team will continue to serve members at the Mission Hills branch after the merger.

Will my accounts continue to be insured?

Your accounts will remain safe, sound and federally insured through the National Credit Union Share Insurance Fund, a U.S. Government Agency, just as they are today.

Will I still receive personalized service?

Yes, of course! You will absolutely continue to receive the same personalized service you do today. In fact, we’ll have the resources to offer you even better service. The primary reason for our two non-profit cooperative credit unions to explore

this merger is to better serve our member-owners.

Will the merger affect membership eligibility?

No. The combined credit union will continue to serve all of the organizations, companies and sponsors we currently serve. It will also provide credit union membership opportunities to new communities and members that we have been unable to serve in the

past.

What if I have additional questions?

We’re here to answer your questions! Please don’t hesitate to call us at (818) 365-6947 or email us at mailto:[email protected] if have any questions about this partnership and what it means to you.