Build your score. Build your life.

YOU’LL LIKE HOW ADDED ADVANTAGE ADDS TO YOUR LIFE.

Added Advantage lowers loan rates, increases interest on our certificates, gives cash back incentives, waives fees on HELOC loans and offers exclusive support. All you have to do is enroll and build your score to get MAX BENEFITS, which is as easy as banking with Nuvision.

We Added Real Benefits Then Made Them Easy to Get!

Save Big on Every Loan

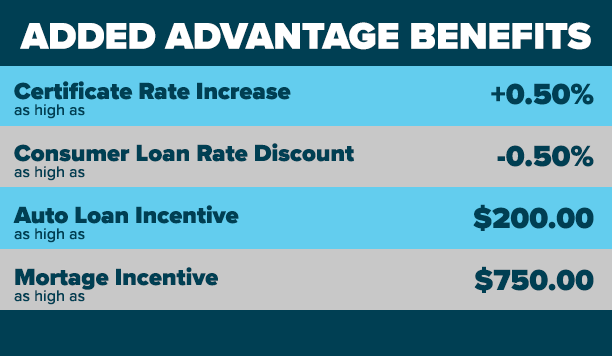

Added Advantage members get exclusive rate discounts on personal, and auto loans.1 Whether you’re buying a new car or consolidating debt, these lower rates help you save more with every loan.

Benefit From Higher Certificate Rates

With Added Advantage, you’ll earn higher interest on certificates2, helping your savings grow faster. It's an easy way to maximize your returns and make sure your money is working as hard as you are.

Dedicated Personalized Support Line3, Just For You

Access to our exclusive support line means you’re never alone when you have questions. Whether it’s a quick inquiry or personalized financial advice, our team is always ready with the help you need!

What Else Can You Expect From Added Advantage?

1 Year of Experian Identity & Fraud Protection4

HELOC Annual Fee Waived5

Cashier’s Check Fee Waived6

Debit card limits can be increased7

Domestic Wire Fee Waived8

Bounce protection limit Increases9

Mortgage10 & Auto Loan Incentives11

Enrolling is simple! Just Fill out the Form Below.

“How do I get MAX BENEFITS?”

It's Easy!

NUVISION makes it easy to get the incredible benefits that comes from being an Added Advantage member.

For example, if you get an auto loan of more than $5,000 and have checking or savings deposits over $5,000, you get our MAX BENEFITS.

And if you get mortgage of more than $50,000 you get MAX BENEFITS too. It’s that easy.

Added Advantage is more than a loyalty program, it’s a relationship program. Even if your score goes down, you still keep the maximum level of benefits as long as you’re a Nuvision Member.

*The total balances of checking and savings are important. The higher the deposits, the higher score rewarded. Combining those with another product will bring you max benefits.

IT’S THAT EASY TO GET MAX BENEFITS FOR LIFE!

NOT AN ADDED ADVANTAGE MEMBER? ENROLL HERE, START BANKING, LET THE BENEFITS BEGIN

LOOK WHAT ADDED ADVANTAGE JUST ADDED TO THE HOLIDAY SEASON!

ENTER UNTIL DEC 9! WIN $3000 GRAND PRIZE!

OUR HOLIDAY CASH GIVEWAY AUTOMATICALLY ENROLLS YOU IN ADDED ADVANTAGE!

Added Advantage is the relationship program that helps build your life.

ADDED ADVANTAGE FAQ

Added Advantage is our member recognition program that provides benefits and rewards you'll actually use, with no fees to join. From everyday banking activity to regular engagement, the more you do with Nuvision, the higher your score will grow. And with several levels of benefits tied to your score, you get easy access to lower rates, discounts on standard fees, loan incentives and so much more.

Joining the Added Advantage Program is simple and free for all Nuvision members. You can enroll in two easy ways: (1) Complete the enrollment form above, or (2) Log in to your digital banking account at nuvisionfederal.com, select “Member Loyalty Program” from the main menu, and click “Enroll Now” button on the page, and you will be automatically enrolled in Added Advantage.

Simply log into your Nuvision digital banking account and select “Member Loyalty Program” on the main menu. Your current score will be displayed, along with a summary of the benefits tied to your score level. Your Added Advantage score will also appear on your statements after you’ve enrolled in the program.

- Consumer Loan Rate Discount: Excludes Mortgage, Visa, and Share Secured loans. Does not apply to variable rate loans or promotional loans unless otherwise disclosed. Consumer loan rate discount is based on Added Advantage score at the time the member applies for the loan. Consumer loan rate discount cannot be combined with any other rate discount other than Automatic Payment Discount and Auto Loan Incentive. Consumer loan rate is based on individual credit worthiness. Auto loan rate cannot go below the floor rate. Visit the Nuvision Federal Credit Union website for current rates. Rates subject to change without notice. Some additional restrictions may apply. Subject to credit approval.

- Certificate Rate Increase: Applicable towards new certificates and renewing certificates with a cap of $250,000 aggregate balance. Rate will apply for initial term of certificate. Minimum 12 month term required. Renewal rate dependent on Added Advantage score at time of renewal. Certificate is subject to early withdrawal penalties which may reduce earnings. Cannot be combined with any other offer. Your enrollment in the Added Advantage program will not apply to any existing certificates accounts until renewal. Visit the Nuvision Federal Credit Union website for current rates.

- Qualification for this feature requires a score of 350+.

- Exclusive Identity Theft & Fraud Protection: This offer is good for one year of free monitoring after activation. Only applicable to members with Added Advantage Score of 100 or higher. Enrollment is not automatic. Member must redeem code provided by Nuvision representative. May be subject to 1099 Misc. tax form at year-end for tax reporting purposes.

- HELOC Annual Fee: The HELOC annual fee is waived with qualifying score of 100 or higher once member has enrolled into Added Advantage, waiver is not retroactive and will be applied to the next annual fee.

- Cashier’s Check Fee: The $5.00 Cashier’s Check fee is waived with qualifying score of 100 or higher. Not applicable at share branches.

- Debit card limits can be increased upon request for members enrolled in Added Advantage.

- Fee waived once monthly for members enrolled in Added Advantage with more than 200 AA points.

- Bounce protection limits are automatically increased for members enrolled in Added Advantage for members with scores 200 or more. Must be opted into Bounce Protection and meet all Bounce Protection requirements. (Bounce protection has a base limit of $750.)

- Mortgage Incentive: Offer applies to new or refinanced 1st Trust Deed Mortgage loans at Nuvision Federal Credit Union. Minimum mortgage loan amount of $250,000. Member must be enrolled in Added Advantage prior to loan application to qualify for incentive. Mortgage incentive value is based on Added Advantage score at time member applies for loan or 90 days before loan funding, whichever date is closer to loan funding date. The mortgage incentive will be credited to the member’s primary savings account within 45 calendar days of mortgage loan funding. Limit one mortgage incentive per eligible household per 12 months. Cannot be combined with any other offer. Subject to credit approval. May be subject to 1099 Misc. tax form at year-end for tax reporting purposes.

- Auto Loan Incentive: Applicable towards an auto loan with Nuvision Federal Credit Union for new or used vehicles. Refinancing an existing Nuvision auto loan does not qualify. Auto loan incentive value is based on Added Advantage score at the time the member applies for the loan. Member must be enrolled in Added Advantage prior to loan application to qualify for incentive. The auto loan incentive will be credited to member’s primary savings account within 45 calendar days of auto loan funding. Limit one auto loan incentive per member per 12 months. Cannot be combined with any other Auto Loan Incentive other than Added Advantage Consumer Loan Rate Discount and Automatic Payment Discount. May be subject to 1099 Misc. tax form at year-end for tax reporting purposes.

* Cumulative balances are based on a 12-month rolling average.